Skilling is a Scandinavian-owned fintech company that specializes in online FX and CFDs trading. As of writing, they provide trading in over 1000+ instruments through Skilling Trader, MT4, and cTrader.

In summary, Skilling offers a safe and secure trading environment for both beginners and professionals. Our Skilling Review will cover all aspects of the company, including our own experience from 12 months of trading.

Key Facts About Skilling

| 💡 Founded | 2016 |

| 🏢 HQ | Cyprus |

| ⚖️ Regulation | CySEC, FSA |

| 🖥️ Platforms | Skilling Trader, MT4, cTrader |

| 💳 Min. deposit | $100 |

| 💰 Base currencies | USD, EUR, SEK, NOK, GBP |

| 🔑 Type of broker | No Dealing Desk (NDD) |

| ☎️ Support | 24/5 |

| 💸 Leverage | Up to 1:500 |

| 🔗 Website | skilling.com |

Skilling Pros and Cons

- No dealing desk (NDD)

- ECN-pricing

- Fast 24/5 customer support

- Spreads from 0.1 pips

- Leverage up to X500

- Exchange pricing on cryptos

- 50+ crypto currencies

- 1000+ instruments

- MT4, cTrader, Skilling Trader

- No FCA regulation

- Sparse educational material

Account Opening

Opening an account with Skilling is very easy and straightforward.

When you register with Skilling, you only need to submit your email-address and create a password in order for you to access the Skilling dashboard of your account.

The account is automatically created as a demo, -and you are able to practice trading risk-free in a matter of seconds.

In order for your account to be legally verified, all you have to do is to upload a picture of the following:

1. Proof of Address (utility bill, bank statement, etc

2. Proof of Identity (passport, identity card, etc.)

Citizens of Norway and Sweden can verify themselves in seconds using BankID.

🏆 Best Overall Broker 2022

✅ Up to 1:500 leverage

✅ Skilling Trader, MT4 & cTrader

✅ 900+ instruments

✅ Nordic Fintech

✅ Fast 24/5 customer support

Regulation and Security

Skilling is licensed by the Cyprus Securities and Exchange Commission (CySEC) with license number 357/18 and the Seychelles Financial Services Authority (FSA) with license No. SD042.

Being a CySEC regulated broker, Skilling Ltd. has passported and is authorized to provide its services to countries within the European Economic Area.

Furthermore, Skilling Ltd. is authorized to operate within the United Kingdom by the British Financial Conduct Authority (FCA), under reference number 810951.

We have been informed that a full UK license is most likely to be expected in 2022.

Your deposits with Skilling are placed in segregated bank accounts with top-tier banks, which ensures that client funds cannot be used for any other purpose than serving as collateral for your trading-activity.

Furthermore, clients who opt for the CySEC license are protected by the Investor Compensation Fund for Customers of Cypriot Investment Firms (CIFs), which protects clients’ funds.

Having said that, -given a (worst case) potential insolvency or similar occurrence the said funds are as previously stated kept in segregated client accounts, as they by regulation are not allowed used for any other purpose than serving as collateral for clients’ trading activity.

With Skilling passwords are fully encrypted and your personal details are stored on secure servers and cannot be accessed by anyone unauthorized.

Deposit and Withdrawal

Skilling charges zero fees for deposits and withdrawals.

You might be charged by your local bank, or your payment service provider (i.e. Skrill, Neteller, Visa, MasterCard, etc.), but not by Skilling.

Minimum deposit with Skilling is $100 or equivalent in your account currency.

Skilling currently allows for account openings in the following currencies; EUR, GBP, USD, SEK, NOK.

Withdrawals are super quick and processed within 24 hours.

Multi-Currency accounts

Skilling also supports multi-currency accounts, so that you for instance can keep one account in Euros and another trading account in Dollars.

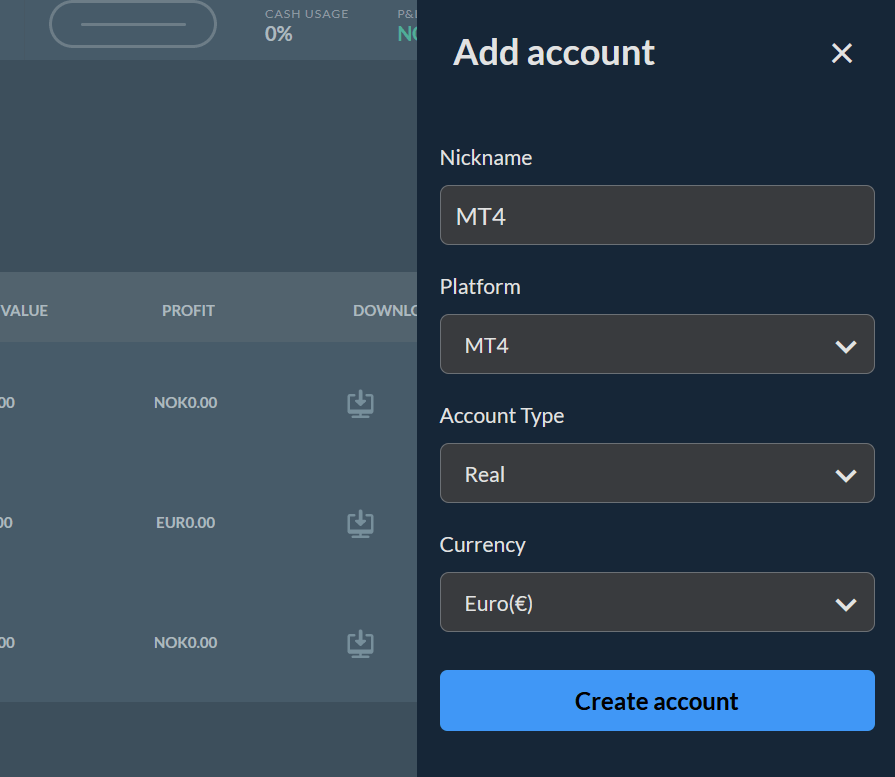

Simply click “Add Account” under “Accounts” in the Skilling-Trader platform in order to open an additional trading account.

You can choose which platform (Skilling Trader / cTrader or MT4) and which currency the account should be nominated in.

Leverage

Leverage is first and foremost dependent on which regulated entity you choose to sign up with upon opening your Skilling trading account.

You are of course free to choose, -but by default most European clients opt for the CySEC license, which offers leverage levels up to 1:30.

The FSA license (Seychelles) is initially meant for clients outside the EU/EEA and offers considerably higher leverage:

| Asset | Max Leverage | Margin Requirement |

|---|---|---|

| Major FX | 500:1 | 0.20% |

| Minor FX | 200:1 | 0.50% |

| Gold | 200:1 | 0.50% |

| Major Indices | 500:1 | 0.20% |

| Minor Indices | 100:1 | 1% |

| Commodities | 100:1 | 1% |

| Stocks | 10:1 | 10% |

| Cryptos | 5:1 | 20% |

Professional Status (EPC)

Clients who sign up under the Skilling CySEC license will initially be classified as retail clients, but are perfectly allowed to request to be reclassified as Elective Professional clients provided that at least two of the following 3 criteria’s are met:

1. Volume & Frequency of trading

You have traded significant volumes, in the Forex/CFD markets or other leveraged products (e.g. indices, stocks, spot FX, futures, options, other derivatives, etc.) with an average frequency of at least 10 transactions per quarter over the previous four quarters (with Skilling and, -or other brokerages).

Significant-sized trades are classified as having a notional value of €10,000 for equities and €50,000 for forex, indices, and commodities or the equivalent in local currency.

2. Size of Portfolio

The size of your financial portfolio, defined as; ‘cash deposits and financial instruments exceeds €500,000 (or the equivalent in local currency).

Acceptable portfolios: Cash savings, stocks and shares, ISA, trading accounts, mutual funds, SIPP (excluding non-financial instruments).

Unacceptable portfolios: Company pension, non-tradeable assets, property, luxury cars, jewelry etc.

Kindly note that you merely need to provide documentation on these assets. The minimum deposit size is the same for both professionals and non-professional clients.

3. Relevant Experience

You work or have worked in the financial sector for at least one year in a professional capacity that requires knowledge of the transactions or services envisaged.

Given you request and are found to have sufficient experience to be considered as a professional client, you will be reclassified as a so-called ‘Elective Professional Client’.

Account Types

Skilling offers two main types of accounts: Standard, Premium

Both account types are available regardless of chosen trading platforms.

Scalping is allowed, and both account types come with negative balance protection.

You can also have a corporate account, swap-free account (Islamic account), and an unleveraged account.

Standard

A standard Skilling account is ideal for just about anyone. It’s a zero commission account available on Skilling Trader and Skilling cTrader, with spreads from 0.7 pips.

The minimum deposit is $100 and the leverage for retail clients is up to 1:30 under the CySEC licence and up to 1:500 under the FSA license.

Premium

The Skilling premium account differs from the standard account mainly on the spreads (from 0.1) and that it has a low volume-based commission associated with it.

Given the low spreads, the starting deposit is higher (5,000 €) or the equivalent in your local currency.

The Skilling premium account is available on Skilling Trader, Skilling cTrader, and the MT4 trading platform.

MT4

Using MT4 with Skilling is very easy. You can choose to trade via the web version or download the MT4 trading platform directly from Skilling.

If you prefer to trade via mobile, you simply download the official MT4 app and connect this your Skilling MT4 account.

Corporate Account

A Skilling corporate account will be opened in the name of the legal entity, and then it will be categorized according to the criteria(s) of the account types mentioned above.

I.e, it can be either a Standard, Premium, or MT4 account.

Corporate accounts under the CySEC regulation can also apply for professional status.

Islamic Account

The Islamic Account is available for clients of the Muslim faith only.

During the first 5 days, the Islamic Account will not be charged any fees and/or commissions on major and minor forex, metals, commodities & indices.

From the 6th day onward, the account will be subject to commissions only, -and no swap charges whatsoever.

Keep in mind that you must manually request your Skilling account to become swap-free via customer support (live chat).

Unleveraged Account

With this account type, you can trade cryptos and stocks without any leverage, i.e. the default leverage is set to X1.

You are still trading CFDs, so the stop-out level is still by default at 50%, but you won’t be charged any swaps on crypto positions which are perfect for longer-term investors.

In order to open an unleveraged account, you simply click “Add Account” in the Skilling Trading platform and then manually request customer support to change the new account to an unleveraged one (live chat).

This is very easy, and your new unleveraged account is ready right away.

🏆 Best Overall Broker 2022

✅ Up to 1:500 leverage

✅ Skilling Trader, MT4 & cTrader

✅ 900+ instruments

✅ Nordic Fintech

✅ Fast 24/5 customer support

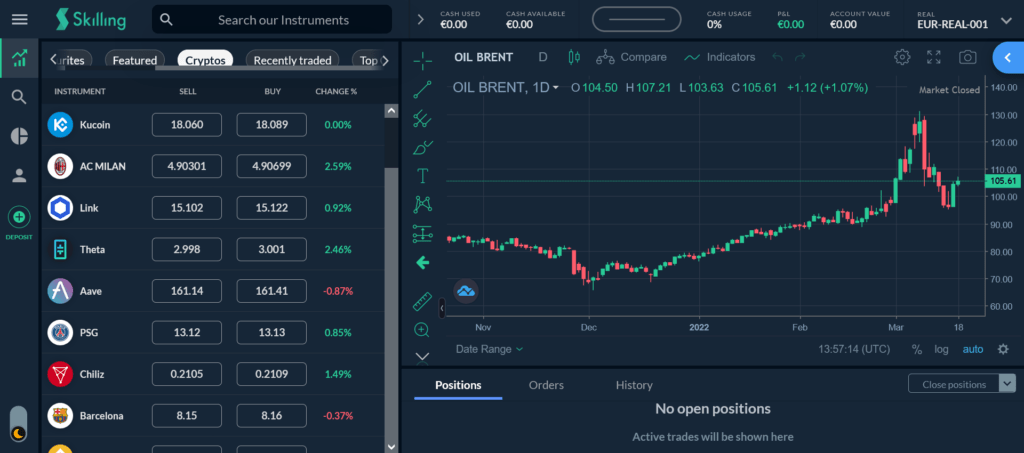

Trading Platforms

Skilling offers three trading platforms, their proprietary trading platform Skilling Trader, MetaTrader 4, and cTrader. All the platforms are available on mobile as well.

We have also been informed of Skilling being in the process of integrating with TradingView, and that this is likely to be offered to clients early in the first quarter of 2022.

Skilling Trader

Skilling Trader is their proprietary trading platform, and will suit both beginners and professionals.

The platform is super easy to use and is available through the browser (Web) and on mobile (IOS and Android).

The only thing we miss from Skilling Trader is trailing stop-loss and an integrated economic calendar.

Skilling cTrader

Skilling cTrader is fully integrated with Skilling Trader, and offers more advanced features such as trailing stop-loss, algorithmic trading, advanced orders and much more.

To activate cTrader you must click on “My Account” -> “Accounts” -> “Enable cTrader”.

Skilling MetaTrader 4

For any serious forex broker, the need for MT4 is no getting around… In order to download MetaTrader 4 thorugh Skilling, you must click on “Add Account” and choose MT4 as the platform.

TradingView

We have been informed that Skilling will be seamlessly integrated with TradingView within Q2 2022. This means that you can connect your trading account at Skilling with TradingView, and trade directly from TradingView.

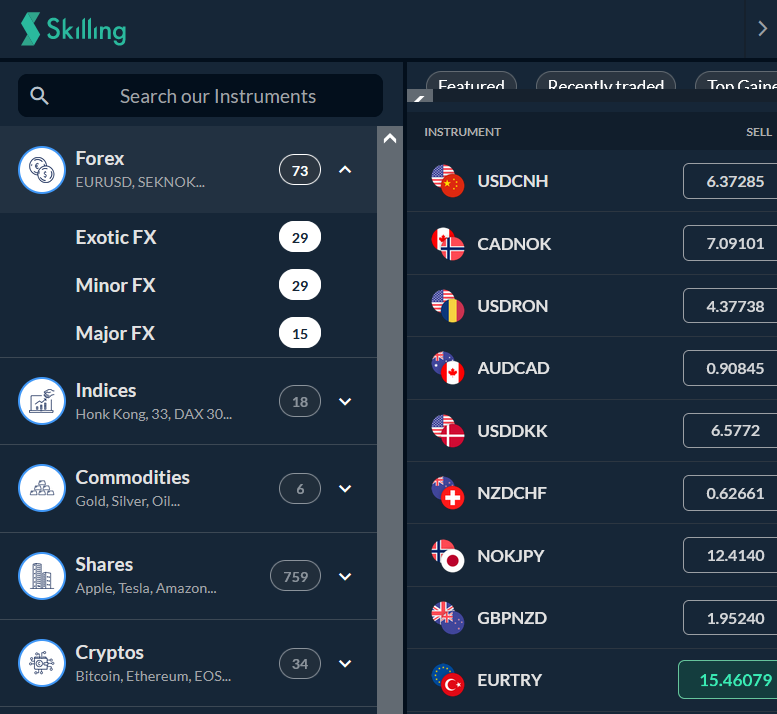

Instruments

Today you can trade with more than 1000 CFD instruments with Skilling.

Please note that some instruments are only available on Skilling Trader and cTrader.

Forex

You can trade more than 70 currency pairs which include all major and minor currency pairs in addition to many exotics.

Crypto

Skilling’s selection of crypto CFDs is definitely among the most extensive crypto offering in the CFD trading market.

Skilling offers 50+ cryptocurrencies. NFT Fan Tokens for Juventus, AC Milan, Barcelona PSG, Roma, and Atletico Madrid are also tradable.

Skilling is very quick to add new cryptos and requests of adding new trading instruments from clients are treated promptly.

Stocks

You can trade more than 700 stocks from all over the world. Traders who like to trade Nordic stocks will also be pleasantly surprised by the wide range of available instruments.

Commodities

The Skilling selection of commodities is sufficient for just about any trader. Crude Oil, WTI Oil, Natural Gas, Gold, Silver, and Palladium are all among the commodities offered.

Indices and ETFs

You can trade all the popular indices in addition to many popular ETFs.

Skilling was among the very first brokers to offer trading in the just recently listed BITO ETF(tracking the Bitcoin price development).

Customer Support

Skilling customer support is available from Monday to Friday, between 04:00 and 22:00 CET to answer any of your questions via live chat, telephone, or email.

All Skilling traders get a personal account manager who you can choose to contact directly if you need support or have any questions.

You can visit the Skilling help desk, where you typically will find answers to many of the most frequently asked questions.

Education and Research

Skilling offers quality educational material via Skilling Academy which covers both basic and advanced aspects of trading.

In addition, Skilling regularly publishes well-written e-books about trading-related matters.

You will get market updates and technical analysis via their blog, Facebook, Instagram and through emails continuously (can be turned off).

Trading Features

Skilling Copy

Skilling offers Copy Trading via cCopy – an award-winning system integrated with the Skilling cTrader platform.

With Skilling cCopy you can automatically mirror the strategies and trades of more knowledgeable traders with proven track records.

The in-depth performance statistics available allows you to research Strategy Providers and their track records, as well as review their performance and trading style in order to best determine the strategy most suitable to you.

Having strategy providers that obviously do their best in order to make profits as they trade their own accounts where you can opt to copy automatically is definitely a great plus.

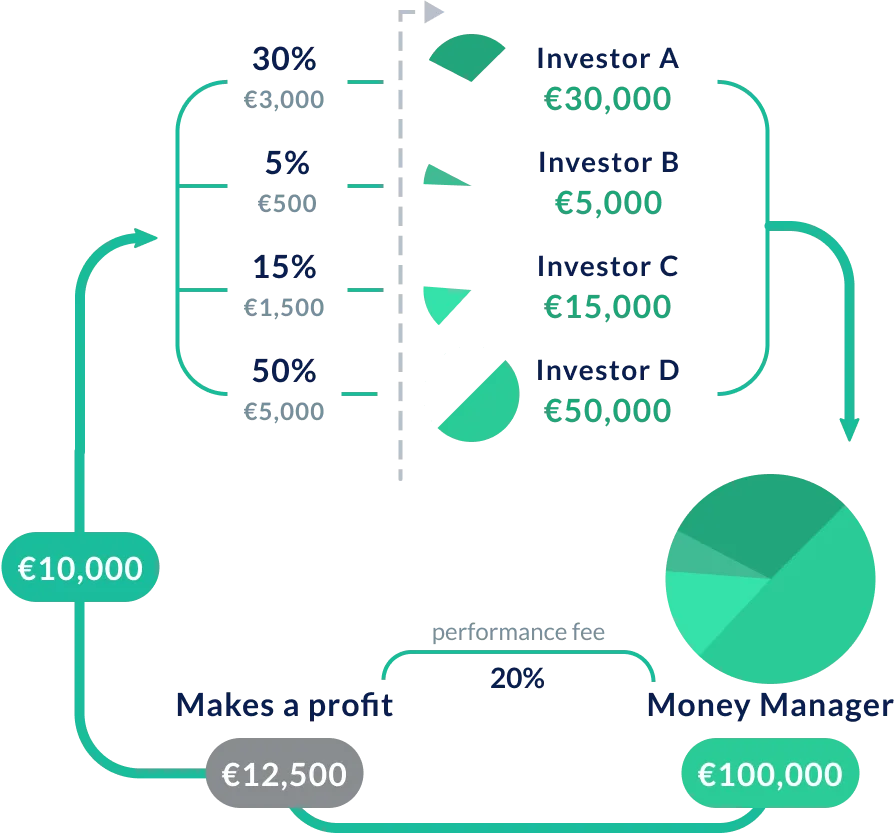

PAMM/MAM Solutions

Skilling offers PAMM accounts (Percentage Allocation Money Management). PAMM is a trading setup that allows investors to allocate funds to a trader or money manager of their own choosing, who in turn manages these pooled funds across multiple trading accounts.

The money manager will typically receive a performance fee (in accordance with a ‘high-water mark model’) which is a set percentage calculated from the trading gains. The profits/loss is distributed back to the investors according to the percentage allocation they each have in the total pool of funds.

Flow chart of the PAMM account system:

Please note that Skilling PAMM is only available for money managers under the FSA license and licensed managers under the CySEC license.

Business Model

Skilling does not have a dealing desk, and never does any manual trading interventions.

We reached out to the Head of Trading, Lennart F. Clausen, for a statement regarding this:

“Skilling applies a hybrid model where Skilling acts as counterparty to every single transaction with clients, but where at Skilling’s discretion, some trades might be sent directly to external liquidity providers for market execution.

Every Skilling client can be assured they’re quoted the exact same price based on our aggregated liquidity pool. No dealing desk or manual intervention takes place throughout the order & execution process.“

Having many liquidity providers ensures that clients will get sharp and stable quotes even during market turmoil.

We traded extensively with Skilling during the market turmoil in March 2020 and were provided very stable and solid price feeds.

Furthermore, there are no requotes and no broker added slippage.

Our Experience with Skilling

Having tested the Skilling trading platform(s) extensively, -we have deposited and traded relatively large amounts during normal market hours, and further, we have also tested Skilling’s’ pricing in the various trading platforms during times of limited liquidity.

Firstly, trading in both normal and distressed markets (during market shocks of various kinds) we have found all the Skilling trading-platforms to offer the same exact pricing.

Hence, Skilling Trader, Skilling cTrader, and the Skilling MT4 trading platforms are all providing the exact same pricing.

The three trading platforms can actually be traded from the same account, one simply allocates funds to the desired platform from the Skilling dashboard, and the funds are instantly available to trade in the chosen trading platform.

Secondly, upon comparing the pricing of Skilling to other brokers (CMC Markets, Saxo Bank, and others) we found that Skilling offers far better pricing during times of market distress.

Skilling offers very competitive pricing during normal markets, and upon more volatile trading conditions this becomes very noticeable…

This at the same time as trading platforms such as the ones supplied by CMC Markets and Saxo Bank very often tend to freeze up (suspending all trading), and, -or widen the spreads to such a degree that placing an actual trade for all intents and purposes is impossible during these periods.

Further, we have also experienced being stopped out of positions with horrible fills (prices that differ a lot from the actual market prices)

This with both CMC Markets, Saxo Bank, and other large brokers, while the very same positions have been sustained in our Skilling account holding the exact same margin.

In these situations we have of course complained to the brokers in question and these complaints have typically been met by a generic unwillingness and lack of understanding…

Only upon extensive emailing and at the end documenting the actual prices through BIS (Bank of International Settlements) have we then been able to recuperate our funds.

In comparison, we have only once had a minor issue with Skilling (we were once for some reason unable to close a position). In that instance, client services sorted it out the next day, and our (small) loss was credited to our account the same day without any questions asked.

Apart from this one isolated incident, we have continuously been very happy with the execution through all the Skilling trading platforms, and we are happy to report stable and predictable pricing without any slippage experienced.

Also, the customer service with Skilling was very friendly and professional upon sorting out our query.

🏆 Best Overall Broker 2022

✅ Up to 1:500 leverage

✅ Skilling Trader, MT4 & cTrader

✅ 900+ instruments

✅ Nordic Fintech

✅ Fast 24/5 customer support

The History Behind Skilling

Skilling was launched in the summer of 2016 by a team of Nordic entrepreneurs.

The Norwegian-born André Lavold was among the founders and later took on the role as CEO of Skilling.

Among the largest shareholders in Skilling are Optimizer Invest, which has previously been the entrepreneurs and the driving forces behind the IPO of Catena Media in Stockholm, as well as several other successful fin-tech ventures.

Michael Kamerman joined Skilling in 2021, with more than 15 years of experience heading the Skilling competitor FXCM.

He commented the following after joining:

The combination of talent and ambition is a powerful thing, which is why I joined Skilling. I look forward to contributing to the growth of the team and leading the Group into a new stage of strategic development.

Skilling currently has two main branches;

The operational Skilling brokerage is located in Cyprus, and the tech branch is situated in Marbella, Spain.

Skilling states that the choice of Marbella as their tech-hub was a deliberate part of their strategy in order to be able to attract the best tech staff by offering sunny Marbella as their place of work.

Skilling also has branches in London, Kuala Lumpur, and Bogota.

Conclusion and Verdict

Skilling suits both beginners and professional traders, and after trading with Skilling for more than two years with considerable funds, we really don’t have anything to complain about

The company is extremely innovative and requests from clients are adressed promptly.

The option of trading unleveraged cryptos (or other instruments) was highly sought after by some clients and was swiftly implemented shortly after.

The only thing we miss is FCA regulation for UK-based traders who sometimes prefer a local regulator, but we have been told that Skilling is not very far from uptraining a full UK license.