Pepperstone is an online forex and CFD broker with it’s head office located in Australia. Pepperstone provides its services to clients in more than 170 countries worldwide.

Pepperstone offers more than 1,200 assets for trading on modern trading platforms such as MT4, MT5, cTrader, and TradingView.

A multiple award winner, Pepperstone is regulated by several tier-1 regulators and is one of the largest forex brokers with an average of $9.2 billion worth of trades daily and a client base of 300,000+ traders.

Key Facts About Pepperstone

| 💡 Founded | 2010 |

| 🏢 HQ | Australia |

| ⚖️ Regulation | ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

| 🖥️ Platforms | MT4, MT5, cTrader, TradingView |

| 💳 Min. deposit | $200 |

| 💰 Base currencies | USD, EUR, GBP, AUD, SGD, HKD, JPY, NZD, CHF |

| 🔑 Type of broker | No Dealing Desk (NDD) |

| ☎️ Support | 24/5 |

| 💸 Leverage | Up to 1:400 |

| 🔗 Website | pepperstone.com |

Pepperstone Pros & Cons

- No Dealing Desk (NDD)

- ECN/STP processing

- Multiple tier-1 regulators

- Leverage up to 1:400

- Super low fees and spreads

- Quick 24/5 support

- A wide offering of trading tools/features

- Full MetaTrader Suite

- TradingView integration

- cTrader

- Demo accounts expire after 30 days

- No negative balance protection for SCB (offshore) clients

- Limited amount of Exotic currency pairs

- Fees not covered for international bank withdrawals

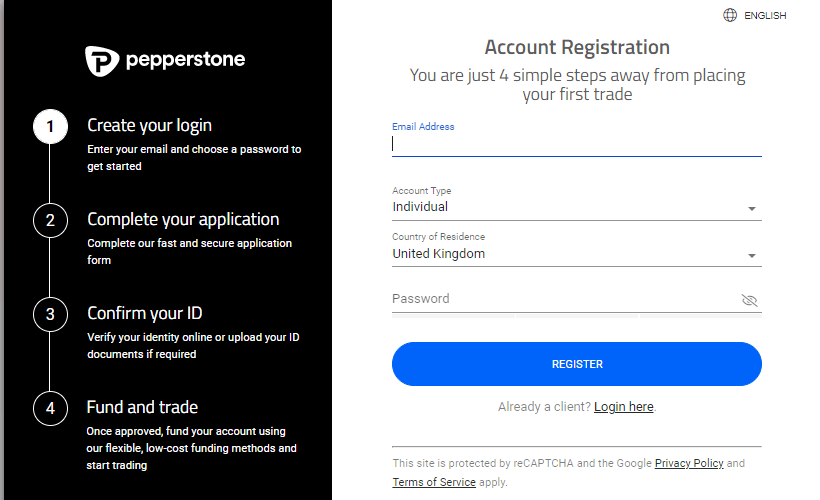

Account Opening

If you are ready to create a new account with Pepperstone, the process is fast and easy.

Step 1: Create an account at Pepperstone

Step 2: Verify your account by uploading the requested documents

Accounts are typically approved within 24 hours.

Step 3: Fund your account and trade with your preferred platform

Deposit and withdrawal

Pepperstone allows its clients to fund their accounts in multiple ways and in multiple currencies.

The options available to you depends on your country of residence, but the most common is VISA/MasterCard or Bank Transfer.

Withdrawals are processed within 24 hours.

Bank Wire Transfer

This is available to all clients irrespective of location or currency. A major deterrent to bank transfers is its processing time; it takes 3-5 working days.

Pepperstone states that the International Telegraphic Transfer (ITT) charges imposed on international transfers by banks are transferred to the client’s account.

This simply means that if you are not from Australia or Europe and you wish to use this method for withdrawal, you will pay a fee of $20 or its equivalent in your currency.

Credit/Debit cards

Most credit and debit cards can be used to fund your Pepperstone account. Card deposits are instant and there are zero fees associated with deposits and withdrawals.

ePayments

Online payment methods like PayPal, Skrill, Neteller, Union pay, BPay, POLi, M-PESA, etc. are available to clients depending on their country of residence. Transaction fees vary between processing platforms.

🏆 Best TradingView Broker 2022

✅ 1:30 | 1:400 leverage

✅ MT4, MT5 & cTrader

✅ 1200+ instruments

✅ Raw interbank spreads

✅ Fast 24/5 customer support

Regulation and Security

Pepperstone Group is made up of sub-entities registered and regulated in several countries as follows:

- Pepperstone Ltd (UK) is authorized and regulated by the Financial Conduct Authority (FCA) with reference number 684312.

- Pepperstone EU Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 388/20.

- Pepperstone Group Ltd is licensed by the Australian Securities and Investments Commission (ASIC) with AFSL number 414530.

- Pepperstone GmbH is regulated in Germany by the Federal Supervisory Authority (BaFin) with ID-number 10151148.

- Pepperstone Financial Services Ltd is regulated by the Dubai Financial Services Authority (DFSA) with reference number F004356.

- Pepperstone Markets Kenya Ltd is regulated by Capital Markets Authority (CMA) with license number 128.

- Pepperstone Markets Ltd is regulated by the Securities Commission of the Bahamas (SCB).

A client’s country of residence determines the regulatory authority and services available to him.

For example, clients from Africa fall under the jurisdiction of CMA, EU clients are under CySEC regulation, German and Austrian clients fall under BaFin, UK clients are under FCA, etc.

All clients’ funds are held in segregated bank accounts in reputable banks.

This means that even if Pepperstone becomes insolvent, clients’ funds will not be used to bail out the brokerage; instead, the segregated funds will be returned to the depositors.

Clients from the UK are additionally protected by the Financial Services Compensation Scheme (FSCS) which insures clients’ deposits up to £85,000 in case Pepperstone goes bankrupt and shut down its services.

European clients (CySEC) are also protected up to an amount of €20,000 through the ICF (Investor Compensation Fund).

Fees and Spreads

The trading fees charged by Pepperstone depend on the account type, trading instrument, and the trading platform. Generally, the fees are low compared to competitors.

For standard accounts, the average spread for the benchmark EURUSD is 0.77 while the minimum is 0.6 pips.

Commissions are charged from Razor accounts. For forex and stock CFDs, the commission is $7 round turn for each lot. On the cTrader platform, the commission is $6/lot per round turn for each lot.

Share CFDs on MT5 are charged at $0.02 per share. Admin fees are only charged on swap-free accounts (Islamic Accounts) after 10 days of holding an open position. The admin fee on 1 lot of forex trade is $50.

Furthermore, active traders can join the ‘Active Trader Program’ to earn daily discounts on trading commissions. High-volume traders may earn up to 30% discounts on commissions.

Leverage

When creating a Pepperstone account, you can choose leverage from the options available to you.

Bear in mind that retail traders from Europe are limited to a maximum leverage of 1:30 on major currency pairs as stipulated by the European Securities and Markets Authority (ESMA).

But, traders opting for other regulated jurisdictions, such as SCB, may choose as leverage up to 1:400.

🏆 Best TradingView Broker 2022

✅ 1:30 | 1:400 leverage

✅ MT4, MT5 & cTrader

✅ 1200+ instruments

✅ Raw interbank spreads

✅ Fast 24/5 customer support

Account types

Being a global broker, Pepperstone supports multiple account currencies.

9 account currencies are available: USD, GBP, EUR, AUD, NZD, SGD, JPY, CHF, and HKD.

There is no restriction of strategies; scalping, use of trading systems, and robots are all allowed.

Pepperstone offers two types of accounts:

Standard account

This account is best for new traders and clients who prefer to pay spread charges instead of commissions. The average spread on the most traded currency pair; EURUSD is 0.6 pips.

Razor account

This account is best for experienced traders, scalpers, or traders who deploy trading systems and trading robots.

The average spread on the EURUSD is 0.0 – 0.3 pips and commissions are charged for each lot traded.

Swap-free accounts

These accounts do not incur swap fees when positions are left open overnight. However, admin fees apply when a trade remains open for 10 days.

This special account is strictly for Muslim traders who are forbidden by their faith to pay or receive any interest fees. These accounts are available on request.

Demo accounts

These are practice accounts that simulate trading in a risk-free environment. It is free on all platforms and comes with up to $50,000 in virtual funds.

This account allows traders to test and hone their strategies before switching to real trading. But, Pepperstone demo accounts expire after 30 days.

Trading platforms

Pepperstone does not have a proprietary trading platform, but the broker offers its traders third-party sophisticated trading platforms; MT4, MT5, cTrader, and TradingView.

All the platforms are available on windows desktop, mobile apps, and through web browsers.

MT4 and MT5

These two trading platforms were designed by ‘MetaQuotes Software Corporation’. MT4 was launched in 2005 while MT5 in 2010.

So far, MT4 is by far the most popular trading platform among forex traders all over the world.

Both platforms look the same in terms of design, interface, and features, -but the MT5 is more complex and comes with more powerful tools.

Both platforms support technical analysis using powerful charting tools, technical indicators, and analytical tools.

You can extend their features using plug-in apps but apps built for the MT5 will not work on the MT4 and vice versa.

This is because both platforms are not compatible. Both support the automation of strategies using Expert Advisors (EAs).

cTrader

This is a robust forex and CFD trading platform with lots of advanced features. cTrader was released in 2011 by Spotware Systems; a fintech company based in Cyprus.

It comes with a customizable user-friendly interface, multiple order types, and risk management tools. Charts are detachable and customizable.

They can be displayed on 26 timeframes and comes with 65 technical indicators. You can build your own trading robot or indicators using cTrader automate. It comes with a video library to further help prospective traders with knowledge.

🏆 Best TradingView Broker 2022

✅ 1:30 | 1:400 leverage

✅ MT4, MT5 & cTrader

✅ 1200+ instruments

✅ Raw interbank spreads

✅ Fast 24/5 customer support

TradingView

TradingView is a sophisticated charting platform used by more 30 million traders. Here are some of TradingView’s keyfeatures:

- Market alerts for various market conditions. This means that traders do not have to constantly monitor the charts as they will be alerted when preset changes happen.

- In addition to the more than 100 popular indicators that are included, TradingView also allows traders to build custom indicators using ‘Pine Script’ programming language which is very easy to learn.

- TradingView Supports multi-frame analysis; you can also customize your timeframes, unlike most platforms.

- Trade directly from the charts, -and on any device.

- TradingView comes with an extensive ‘economic calendar’ which is a important tool in fundamental analysis.

- Through TradingViews Social network; you can research trading ideas, analysis, videos, or chat in real-time with other traders in the vast community.

To start using TradingView, you first open a Pepperstone Razor account and connect it to TradingView. The integration is powered by cTrader.

Instruments

Pepperstone offers more than 1,200 forex and CFD instruments for trading on its platforms. They are as follows:

Forex

There are more than 60 currency pairs available. Traders can speculate on the price movements of the major, minor and exotic forex pairs.

Pepperstone offers CFDs on stocks as traded in various exchanges in different countries. The following share CFDs assets are available:

- More than 600 stocks CFDs from the NASDAQ and New York Stock exchange (NYSE).

- CFDs of more than 100 stocks from the London Stock exchange.

- More than 200 Australian stocks.

- German stocks.

Index CFDs

On the Pepperstone platforms, you can trade on the price movement of more than 20 major stock market indices. You can also trade currency index CFDs like the US Dollar index, Euro index, and the Japanese Yen index.

ETF CFDs

Exchange-traded funds (ETFs) are investment baskets that track the performance of a stock, index, and other assets. They are traded on stock exchanges just like equity stocks.

Pepperstone clients can trade more than 100 CFDs on ETFs across various sectors aggregated from 35 countries in 6 continents.

Commodity CFDs

You can trade CFDs in spot precious metals, energies (oil, gas etc.), and agricultural commodities like cocoa, coffee, cotton, wheat, etc.

Customer Support

Pepperstone has a dedicated client support desk that is available 24/5 and speaks several languages. To help clients find information fast, the support pages also have lots of FAQs grouped into several topics such as funding, account opening, platforms, trading-tools etc.

If you still need to reach the support team, you can send an email or call them by phone. You can also reach the support team on live webchat or WhatsApp. On social media, Pepperstone is active on Facebook, Twitter, LinkedIn, and YouTube.

Education and Research

Pepperstone has a team of in-house expert analysts who research and analyze the markets daily. They prepare and present in-depth market research, training articles, webinars, news, and analysis to help Pepperstone clients.

This is some of the Pepperstone research and analysis material that is published regularly:

Education

There are articles on the website that introduces key concepts in forex trading. They are strictly for beginners. Also, there are two forex trading video courses.

The MT4 course teaches you how to use the platform while the forex trading course has 9 video lessons taught by different analysts.

Market analysis

This is a daily article that focuses on the analysis of selected assets. It usually presents trading ideas using fundamental and, -or technical analysis.

🏆 Best TradingView Broker 2022

✅ 1:30 | 1:400 leverage

✅ MT4, MT5 & cTrader

✅ 1200+ instruments

✅ Raw interbank spreads

✅ Fast 24/5 customer support

Trade off

‘Trade off’ is a weekly video presentation featuring discussions and debates about the financial markets. It comes up weekly.

Daily Fix

This is a daily analysis update prepared by Pepperstone’s head of research ‘Chris Weston’. You can sign up to receive Daily Fix in your email every market day.

Webinars

Pepperstone always schedules training webinars on its website.

The webinars are often facilitated by Pepperstone’s investment manager (Tyrone Abela) and Chief Technical Analyst (Thomas Atkinson). Sometimes other members of the analysts’ team olso take charge.

You can always watch the previous seminars on the website. New seminars come up every two weeks.

Trading Features

AutoChartist

This is a powerful technical analysis tool that reduces the workload for traders. AutoChartist software constantly scans the markets, identifies trading opportunities, and alerts the trader.

It also comes with probability filters, risk management tools, volatility analysis, technical indicators, and daily market reports.

To use AutoChartist, you need to first customize the software to suit your preferences. Pepperstone traders can use AutoChartist via its web application, android or iOS mobile apps, MT4 plug-in, and even from the secure clients’ area.

Virtual Private Server (VPS) Hosting

VPS is usually demanded by professional traders who need unrestricted access to the trading servers. It is also needed by traders who use trading systems like EAs, social trading, etc.

Pepperstone has partnered with ‘FXVM’ and ‘New York City Servers’ (NYC) to provide reliable VPS hosting services to all clients. This ensures reliable and unrestricted access to the trading servers.

These providers offer premium services to Pepperstone clients at discounted rates; 25% for NYC and 20% for FXVM.

Social trading

Investors and novice traders can benefit from Pepperstone’s social trading services which are provided on the courtesy of various platforms.

Social trading enables investors to automatically copy the trades of expert traders, replicate their strategies and possibly make profits.

The copier may not even know how to trade but only chooses an expert, sets some parameters, and fund his account.

Each time the expert is trading, the trades are automatically replicated in your account. The expert trader receives commissions from his copiers when he makes profits.

Pepperstone clients have options of DupliTrade, Myfxbook, or MT signals for their copy trading (not applicable for EU/EEA clients).

DupliTrade

To use DupliTrade, you must have a minimum balance of AUD 5,000 or its equivalent in your currency.

DupliTrade is a social trading platform that connects numerous traders via the MT4 platform.

A trader can automate his trades by copying the trades of specially selected ‘strategy providers’.

DupliTrade asserts that its strategy providers are carefully selected after a rigorous auditing process to only choose the best experts with proven records.

To enjoy the DupliTrade services, traders will have to create a DupliTrade account and link it to their Pepperstone account.

🏆 Best TradingView Broker 2022

✅ 1:30 | 1:400 leverage

✅ MT4, MT5 & cTrader

✅ 1200+ instruments

✅ Raw interbank spreads

✅ Fast 24/5 customer support

Myfxbook

This is an online website that allows traders to view, analyze and compare account performances and strategies. Myfxbook has its social trading platform known as ‘AutoTrade’.

It is a tool that allows you to view the profiles of strategy providers, analyze their performance histories, and then choose whose trades to automatically copy to your account.

Pepperstone clients can request for ‘AutoTrade’ from the clients’ area and then link it with their accounts.

MetaTrader Signals

On the MetaTrader platforms, you can access various trading signals broadcasted by thousands of expert traders. These signals are useful to the trader in the following ways:

- Signal comparison from different sources improves accuracy.

- Valuable time spent on analysis is saved.

- Relatively cheaper than other signal sources. Some signals are free.

- Diversification with multiple strategies.

cTrader Automate

Formerly known as cAlgo, cTrader Automate is an algorithmic trading solution that comes integrated with the cTrader platform.

It enables traders to backtest their trading strategies, build custom indicators and trading robots. It is based on the C# programming language.

Smart trader tools

This is made up from a set of 26 trading apps comprising EAs and indicators. The toolset can be downloaded and installed on MT4 and MT5. Some of the tools are:

- Alarm manager: Notifies the trader about price, news and even sends updates on social media.

- Connect Feature: Updates the trader with news and analysis.

- Correlation Matrix: Displays the correlation between a group of selected assets.

- Correlation Trader: Used to analyze the correlation between assets across different timeframes.

- Excel RTD: Enables traders to use excel to analyze and report market data in real-time.

- Mini terminal: You can place orders on this small window.

- Sentiment trader: Shows the recent and past buy and ask sentiments on selected assets.

- Market manager: Displays the watchlist, open tickets, etc. You can also place orders.

- Session map: Shows the world map, the time when market sessions will open, and future news events.

- Tick Chart Trader: Displays tick charts in 5 chart styles and allows you to quickly place orders using your mouse or keyboard.

- Trade Simulator: Works with the strategy tester to place orders using historic data.

- Trade Terminal: Market analysis and trading EA.

Also, the Smart trader tools set include indicators as follows:

- Bar Changer

- Candle Countdown

- Chart Group

- Chart-in-Chart

- Donchian

- Freehand

- Gravity

- High-Low

- Keltner

- Magnifier

- Mini Chart

- Order History

- Pivot Point

- Renko Charts

- Symbol Info

Business Model

Pepperstone operates a hybrid brokerage model with no dealing desk and no interventions on client orders.

The broker has partnered with licensed liquidity providers to provide raw interbank spreads starting from 0.0 pips on its platforms.

Pepperstone states that 99.9% of all orders are executed internally except for a few rejections due to technical issues.

With multiple servers located around the world, client orders are executed within 30 milliseconds.

Experience

From Pepperstone’s ‘Personal area’, you can create several accounts including live and demo accounts.

If you want to trade on different platforms, simply create another account for that platform.

After creating multiple accounts and testing out Pepperstone’s features, we can infer that the broker has reasonable trading fees on forex and most CFDs. Spreads are low on all platforms and trade executions are fast.

No minimum deposit is required to create an account; Pepperstone scores high in this regard because most brokers tie a minimum deposit to an account type.

Minimum deposits vary among brokers but the average is often around $100; though some brokers require a minimum of $500 or even more.

🏆 Best TradingView Broker 2022

✅ 1:30 | 1:400 leverage

✅ MT4, MT5 & cTrader

✅ 1200+ instruments

✅ Raw interbank spreads

✅ Fast 24/5 customer support

History

Pepperstone was founded in 2010 by traders to satisfy their needs and tackle the challenges confronting them as traders.

Founded by a team of traders who were irked by high trading fees and poor brokerage services, they came up with an ideal brokerage; Pepperstone was the result.

Pepperstones’ formal mission is “to create a world of tech-enabled trading where ambitious traders can embrace the challenge and opportunity of global markets”.

Today, Pepperstone has grown into a leading brokerage with more than 300,000 clients and Pepperstone holds offices in Melbourne, Limassol, Dubai, Düsseldorf, Nairobi, London, and in the Bahamas.

Conclusion and Verdict

Pepperstone is a global broker with a wide range of services that suits all traders regardless of experience. Pepperstone is regulated in multiple jurisdictions and has been in operation for more than a decade.

It is no surprise that Peppestone has won more than 30 industry awards of excellence.

With no minimum deposit, numerous tradable assets, tight spreads, low commissions, multiple social trading options, analytical tools; Pepperstone stands tall among its competitors.

However, we are not comfortable that demo accounts last only for 30 days and that international bank withdrawals are not free.

But, overall, Pepperstone is a great broker and definitely on its way to greater heights. We safely recommend Pepperstone to our readers.