FxPro is an online global broker established in 2006 and specializes in providing CFD and forex trading services.

It’s regulated by multiple financial authorities around the world including the UK’s Financial Conduct Authority (FCA).

The broker offers its clients multiple account types with a myriad of pricing options, including variable and fixed spreads.

FxPro offers its own proprietary trading platform in addition to cTrader, MT4, and MT5.

| 💡 Founded | 2006 |

| 🏢 HQ | UK |

| ⚖️ Regulation | FCA, CySEC, FSCA, SCB |

| 🖥️ Platforms | Proprietary, MT4/5, cTrader |

| 💳 Min. deposit | $250 |

| 💰 Base currencies | 8 |

| 🔑 Type of broker | No Dealing Desk (NDD) |

| ☎️ Support | 24/5 |

| 💸 Leverage | Up to 1:200 |

| 🔗 Website | FxPro.com |

Account Opening

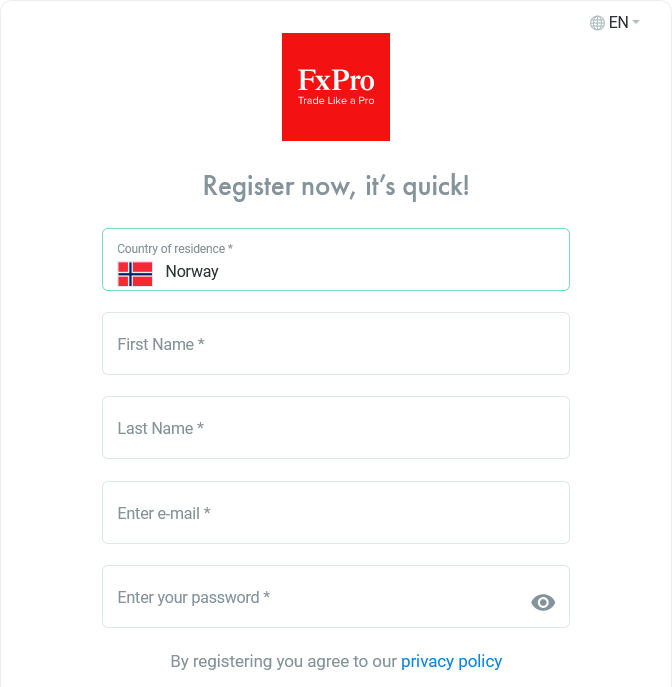

The process of opening an account with FxPro is fast, seamless, and straightforward as the whole process can be completed within two hours and it is completely digital.

Also, the broker accepts clients from around the world with some notable exceptions such as Israel, Canada, and the United States.

The minimum deposit is $100 which is excellent for traders looking to commence trading with a low amount.

The account opening process begins with filling out an online application form which can be completed in minutes.

The process can be completed in English or 17 other languages.

To open an account with this broker, clients will need to go through the following steps:

- Fill in the country of residence, name, and email address before creating a password.

- Fill in nationality, date of birth, phone number, and address of residence.

- Employment information should be added next which includes the level of education, employment status, and industry.

- Provide specific financial information such as annual income, the reason for trading/opening an account, net worth, and source of wealth.

- Provide answers to questions about financial knowledge and trading experience.

- Choose a trading platform (MT4, MT5, cTrader, or FxPro Edge), a base currency, default leverage, and the preferred language of emails.

- Verification of identity and residency. Verification of identity can be done by uploading a copy of passport, national ID, or driver’s license. To verify residency, upload any utility bill or bank statement issued within the last six months.

Deposit & Withdrawal

FxPro provides clients with deposit and withdrawal processes that are free and quick via different channels such as credit/debit cards, bank transfers, and electronic wallets.

Account base currencies

There are eight base currencies available at FxPro and they are EUR, CHF, USD, GBP, AUD, JPY, ZAR, and PLN.

This selection of account base currencies is mildly satisfactory but does not compare favorably with similar brokers as those have more base currencies to offer.

This is important because being able to fund a trading account in the same currency as your bank account means there will be no conversion fees.

Deposit fees and options

FxPro does not charge any deposit fees and apart from using credit/debit cards and bank transfers to make deposits, the following types of electronic wallets are available as well:

- Skrill

- UnionPay

- PayPal

- Neteller

However, the usage of electronic wallets is not available to clients from the United Kingdom.

In terms of deposit, payment by credit/debit card and electronic wallets is immediate while bank transfers can take several business days. Deposits can only be made from accounts registered to a client (third-party deposits are not allowed).

Withdrawal fees and options

This broker does not usually charge any withdrawal fee but there are certain conditions in which a fee is charged.

One of the cases in which a fee is charged is when a client refunds to his/her PayPal account more than six months after the initial funding.

Another case is when a client refunds to Neteller or Skrill without performing any trading activity. Traders should note these conditions.

Withdrawal can only be made to accounts registered in the client’s name and the process of withdrawal is shown below:

- The first step is to log in to the account

- Navigate to ‘Wallet’

- Select ‘Withdrawal’

- Choose the withdrawal method

- Enter the amount for withdrawal

Regulation and Security

FxPro is regulated in several jurisdictions and most clients can choose which regulated entity they want to open an account with.

FxPro UK Limited is authorized and regulated by the Financial Conduct Authority (registration no. 509956).

FxPro Financial Services Limited is authorized and regulated by the Cyprus Securities and Exchange Commission (license no. 078/07).

FxPro Financial Services Limited is authorized by the South-African Financial Sector Conduct Authority (‘FSCA’) (authorization no. 45052).

FxPro Global Markets Limited is authorized and regulated by the Securities Commission of The Bahamas (license no. SIA-F184).

The broker offers negative balance protection to its clients which means if their account balance should ever become negative, they will be protected.

Also, FxPro offers investor protection via its various subsidiaries but the availability and amount vary depending on the region and the regulating authority.

The table below shows the investor protection amount and availability provided by FxPro.

| Regulator | Legal entity | Protection amount |

|---|---|---|

| FCA | FxPro UK Limited | £85,000 |

| CySEC | FxPro Financial Services Ltd | €20,000 |

| SCB | FxPro Global Markets Ltd | No protection |

Fees and Spreads

Fees are generally divided into trading and non-trading fees. The spread forms a part of the trading fees.

Generally, the trading fees of this broker are low although the account type selected by the client determines the pricing structure.

Execution method

On the MT4 offering of FxPro, traders can select between fixed or variable spreads. The pricing of the variable spread consists of two types of execution methods namely: instant and market.

The difference between the two is that instant execution can experience requotes but is free from slippage while market execution can experience slippage but not requotes.

Spreads

In terms of spread, FxPro applies variable spread which can be found on MT4 and MT5 with spreads of 1.58 pips for the EUR/USD forex pair in accounts on market execution (1.51 pips on MT5), and 1.71 pips for accounts with instant execution.

Consequently, fixed spread is not available on MT5. On the cTrader account, the spread is 1.27 pips for the EUR/USD pair.

Non-trading fees

The non-trading fees of this broker are average as it does not charge account fees or withdrawal fees in most cases (as explained above) but it does charge an account maintenance fee which is in the form of a $15 inactivity fee following 12 months of no trading activity.

If the lack of trading activity continues, then the $15 fee is followed by a $5 monthly fee. However, this is restricted to the jurisdiction of CySEC.

Leverage

FxPro utilizes dynamic leverage on the FxPro, cTrader, MT4, and MT5 platforms which adapts automatically to the trading positions of clients.

Therefore, as the volume per instrument of a client rises, there is a simultaneous fall in the leverage offered.

This is done per trading instrument which means if a client should have trading positions open across several instruments, the leverage will be calculated separately.

For instance, if a client has 400 lots of Buy on EURUSD and then initiates trading on USDGBP, the existing EURUSD positions will not interfere with the client’s margin requirement for USDGBP.

The table below shows the maximum leverage for the major financial instruments offered by FxPro.

| Instrument | Maximum leverage (FxPro Global Markets Ltd) |

| Forex majors | 1:200 |

| Forex minors | 1:200 |

| SILVER, SILVEREURO | 1:200 |

| GOLD, GOLDEURO, GOLDoz, GOLDgr | 1:200 |

| Spot Indices Major | 1:200 (cTrader 1:50) |

| Spot Indices Minor | 1:200 (cTrader 1:50) |

| Energy Spot | 1:200 |

| Energy Futures | 1:200 |

| PLATINUM | 1:50 |

| PALLADIUM | 1:50 |

| Future Indices Major | 1:50 |

| Future Indices Minor | 1:50 |

| Commodity Futures | 1:50 |

| US, UK, German, and French Shares | 1:25 |

| Crypto | 1:20 |

It should be noted that the maximum leverage for ZAR crosses is 1:100, for ILS, RUB, CNH, & THB crosses, it is 1:50 while for DKK, HKD, SGD, CZK, & TRY crosses, it is 1:20.

Major currencies refer to any pairing of the following currencies: GBP, EUR, CHF, CAD, JPY, &, USD.

Account Types

The table below shows the various account types offered by FxPro with their differences in execution, pricing, and trading platform.

| Account Type | Pricing | Platform | Execution |

|---|---|---|---|

| MT4 | Floating spread without any commission | MetaTrader 4 | Market |

| MT4 Instant | Floating spread without any commission | MetaTrader 4 | Instant |

| MT4 Fixed | Fixed spread, no commission | MetaTrader 4 | Instant |

| FxPro Platform | Floating spread without any commission | FxPro’s proprietary platform | Market |

| cTrader | Floating spreads with $4.5 per lot roundturn* commission | cTrader | Market |

| MT5 | Floating spread without any commission | MetaTrader 5 | Market |

*Roundturn encompasses both the opening and closing of the position

Instant order is an order for trading to be executed at the price that is displayed in the quotes flow. However, there is a possibility that this specific price is unavailable.

As a result, the order will be requoted with the next price that is available but a client has to be in agreement with the new quote before it can be executed.

A market order is an order to trade at the current available market price– defined as the volume-weighted average price of third-party liquidity providers.

There is also a possibility that the requested price is unavailable which means the execution of the order will be carried out at a different price and it can either be better or worse than the requested price depending on market conditions.

This concept is known as slippage and it could either be positive (better price) which is favorable to the trader or negative (worse price) which is not favorable.

The broker also offers a VIP account as long as clients have a minimum balance of $50,000 (or equivalent in other currencies). It features a Virtual Private Server service and reduced prices. Other kinds of accounts available at FxPro include swap-free/Islamic accounts and corporate accounts.

Trading Platforms

FxPro offers its clients a diverse selection of trading platforms in the forms of MetaTrader, cTrader, and the FxPro Edge which is its proprietary web platform.

These various platform options allow clients to find the one that suits their trading styles. The FxPro Edge features detailed charts and an immaculate design. The charting is seamless and features 53 indicators along with various selectable chart types.

On the other hand, cTrader has 73 indicators and various drawing tools while providing a more glossy charting experience than the MetaTrader platforms.

Overall, FxPro has a nice array of tools and third solutions across its different platforms but it still has some ways to go to catch its competitors.

FxPro MT4 web trading platform

The FxPro MT4 web trading platform features excellent customizability which makes it possible to change the position and size of the tabs.

However, the platform has an obsolete feel and it is difficult to find some useful features.

The search functions are satisfactory but not exceptional as the financial instruments are grouped into categories but you cannot search for the instruments manually by typing the names.

All the basic order types are available for use but the more sophisticated ones are absent.

Below are the order types that can be found on the FxPro MT4 web trading platform:

- Limit

- Market

- Stop

There is also the trailing stop order but this is only available on the desktop platform of the MT4. It is also on the desktop platform that traders can set alerts and notifications as these functions are not available on the web platform.

However, the web platform features precise portfolio and fee reports. This way, clients can easily see their profit/loss balance and the commissions they paid.

It is also available in a wide array of languages numbering close to 50 with major languages such as English, Spanish, Portuguese, Arabic, Chinese, and Hebrew.

Mobile trading platform

The mobile trading platform of FxPro consists of the browser-based mobile version of the FxPro Edge that can be used for trading, managing accounts, and keeping up with basic market news.

There is also the FxPro Direct which is the broker’s proprietary mobile app but has limited functionality as it only supports trading for clients operating a CFD account.

As a result, it is majorly designed for account management and while it features charts, drawing tools and indicators are absent.

The mobile app offered by this broker is virtually limited as it cannot be downloaded to use on Android and iOS smartphones.

However, there are third-party mobile apps from the same providers that power the broker’s web-based and desktop platforms: MetaTrader (MetaQuotes) and cTrader (Spotware).

Unlike the broker’s proprietary mobile app, these third-party mobile apps are available for iOS and Android smartphones.

The focus will be on the MT4 mobile app as it is impressive and has an excellent design along with a solid search function along with ease of use.

The MT4 mobile app is available in the same languages as the web version but this is only for iOS smartphones because, with Android, the app just uses the default language on the phone of the user.

It offers a two-step login along with good search functions as users can search by typing the name of the instrument or by browsing through the category folders.

Instruments

FxPro offers its clients the chance to trade CFDs of underlying asset classes such as stocks, forex, futures, indices, and commodities. However, popular instruments like real stocks and ETFs are unavailable.

As a forex and CFD broker, it offers a wide array of currency pairs and CFDs which is to be expected. The table below shows the financial instruments that are available for trading on FxPro.

| Instrument | Number |

| Currency pairs | 70 |

| Stock CFDs | 1700 |

| Commodity CFDs | 25 |

| Stock index CFDs | 29 |

| Cryptos | 30 |

The IP address of a client determines whether he/she will be able to access crypto trading. This broker allows clients to adjust leverage levels which is good, especially if a client wants to lower the risk of a specific trade.

It is worth pointing out that traders must always be wary when trading forex and CFDs as the preset leverage levels may be extremely high.

Customer Support

The customer support of FxPro is efficient as quick and relevant responses are provided to the inquiries made by clients.

There are three major ways by which customers support can be reached and they are live chat, email, and requesting a call back on the website.

Furthermore, customer support is available in multiple languages up to 18 in number.

The live chat service works well and while customer support cannot be reached directly by phone, clients can always use the call back option that is available on the broker’s website.

This saves clients’ phone costs but then it takes a bit longer before customer support can be reached via this means.

The email support is also working adequately but the only snag with customer support is the lack of 24/7 availability as customer support can only be contacted between Mondays and Fridays but not on weekends.

Education and Research

Education

FxPro offers a well-packaged educational offering that features a demo account and trading platform tutorials. The demo account enables new clients to familiarize themselves with the broker’s platform while also testing their trading strategies to determine the best way to apply these strategies.

The trading platform tutorial videos are for providing further information about the platform to clients so that they can have a better understanding of the different platform selections offered by the broker but this does not cover MetaTrader platforms.

Other educational offerings include general educational videos and written educational materials. FxPro has a YouTube channel where it provides these educational videos. Part of the written materials includes basic online forex courses along with tests for self-evaluation.

Apart from that, there is a detailed guide to technical analysis that can be found on Trading Central. The broker also offers forex webinars but those are not frequent.

Research

In terms of research, FxPro provides detailed technical analysis along with some great tools that provide clients with a quick overview of the market but it only offers limited fundamental data via its economic calendar and FxPro Squawk.

This allows clients to filter for countries and data types which is a very useful tool for those involved in forex trading. The research tools offered by FxPro have three sources:

- A section of ‘Tools’ found on the FxPro Direct site

- A section on ‘Analytics & Education’ is also found on the FxPro Direct site and it encompasses third-party services like LiveSquawk newsfeed and audio commentary along with trade recommendations from trading central.

- MetaTrader trading platforms

Trading Features (write if they have features such as copy trading, PAMM, etc.)

The only trading feature that this broker has is copy trading otherwise known as social trading via third-party platforms.

It does not have PAMM in which clients get to manage the trading portfolio of other clients and then earn additional income from that.

Business Model

The broker uses no dealing desk execution which is possible through connection to providers with deep liquidity.

With the high volumes of trades initiated by its clients, FxPro can match a huge deal of its order flow internally and this enables the broker to minimize its risk without tampering with the orders of its clients.

Its speed of execution is ultra-fast with virtually all the orders of clients getting filled in less than 14 milliseconds.

The broker generates its revenue through spreads that have been built into most trades depending on the account used by the trader.

It is only on the cTrader account that a commission is charged and that is fixed. Its focus on transparency in the process of filling orders means that traders have a clear idea of how much each transaction is costing them.

Experience With FxPro

Our experience with FxPro was solid as the process of account opening was completed within three hours which allowed us to get our account details the day we opened the account.

Also, when we tried to withdraw, we used a debit card and we got our funds on the same day we initiated withdrawal.

When we reached out to customer support, we received quick and relevant responses to our inquiries especially via live chat and email even though the responses via email took a few hours.

Reaching phone support took longer though but overall the answers were precise and detailed which made it easier for us to understand the broker’s process.

However, we wished the broker had a 24/7 availability considering we had to squeeze time during the week to reach support.

Being available on weekends will have made it much easier for us to reach support. Overall, we had a satisfactory experience with this broker.

History

FxPro was founded in 2006 in Cyprus which means it has a long track record. This has added to its credibility as a trustworthy and low-risk broker that traders can be confident of opening an account with.

The broker has grown over the years and is currently operating successfully in over 170 countries in the world serving both institutional and retail clients.

The broker is a recipient of over 85 awards and sets high safety standards by keeping the funds of its clients in large international banks. These funds are also insured and kept separately from the equity of the broker.

The broker continues to expand its operations across the world while also attracting new clients.

Conclusion

FxPro is regulated by multiple financial authorities around the world including the top-tier FCA.

It has a seamless account opening process that is fully digital along with various deposit/withdrawal options free of charge. The customer service is also incredible with multiple languages supported.

However, being a CFD and forex broker, its financial instrument offerings are limited to CFDs and forex while lacking popular instruments like ETFs and real stocks.

The minimum deposit is relatively low which makes it an attractive option for those who are interested in opening a trading account with a small amount of money.

If you are looking to trade mainly forex and CFDs with a small amount of money and an easy process of opening an account, then FxPro might be worth considering.

You can always test the platform via the demo account to see if it suits you before committing any actual money.