eToro is a social trading and investment network with millions of users from more than 170 countries.

Through the eToro platform, users can invest in stocks (0.00% commission) and over 100+ crypto assets.

Traders outside of the USA can also trade CFDs in more than 3000 instruments including stocks, forex, indices, commodities, ETFs, and cryptos.

Copy Trading was made mainstream by eToro and you can automatically copy the trades of the best performing traders on the platform without any performance or managing fee!

In this eToro review, we will cover all aspects of the broker including our own trading experience.

| 💡 Founded | 2007 |

| 🧑 CEO | Yoni Assia |

| 🌐 Offices | Worldwide |

| ⚖️ Regulation | FCA, ASIC, CySEC, FSA |

| 🇺🇸 US clients | Yes |

| 🖥️ Platform | Proprietary |

| 💳 Minimum deposit | $50 |

| 💰 Base currency | USD |

| 🔑 Type of broker | Multi-Asset |

| ☎️ Support | 24/7 |

| 🛒 Products | Stocks, Crypto, CFDs |

| 🔗 Website | eToro.com |

Please note that some services/features from eToro are not available for clients from certain countries. This review is written based on an eToro account in Europe.

Pros & Cons

- 0.00% commission (real stocks)

- Extremely user-friendly

- Copy Trading

- Social Trading

- Tons of educational material

- 3000+ instruments

- Massive crypto offering

- CopyPortfolios

- Tier-1 regulation

- Slow customer support

- High spreads

- High overnight fees (swaps)

- Not suitable for advanced traders

- Withdrawal fee

- Inactivity fee

Account Opening

Opening an account with eToro is straightforward:

Step 1: Register your profile at eToro here

Only username, email, and password are required for a demo account.

Step 2: Verify your account

Submit your personal details, and upload a valid POI (proof of identity) and POA (proof of address). Some clients must take a short suitability test which is required by regulators. Account verification usually takes less than 24 hours, but you can deposit up to $2000 until the account is fully verified.

Step 3: Make a deposit with your preferred payment method

All major payment providers are supported.

Deposit and Withdrawal

The deposit methods will depend on your country of residence, but all major payment providers are supported including Visa, Mastercard, PayPal, Skrill, and Neteller.

The minimum deposit varies between countries, but $50 is usually the absolute minimum.

There are no fees associated with deposits, but if you deposit in another currency than USD, eToro might charge a conversion fee.

eToro charge a flat fee of $5 for withdrawals.

Regulation and Security

eToro is regulated and authorized in several jurisdictions including the United Kingdom, United States, Australia, and the EU.

Which regulated entity you open an account with, depends on your country of residence.

- eToro (Europe) Ltd. is authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license number 109/10.

- eToro (UK) Ltd. is authorised and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

- eToro AUS Capital Limited is authorised by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

- eToro (Seychelles) Ltd. is licenced by the Financial Services Authority Seychelles (“FSAS”) to provide broker-dealer services under the Securities Act 2007 License #SD076

- eToro USA Securities, Inc. is registered with the Securities and Exchange Commission (SEC).

Regardless of which regulated entity you open an account with, all client money is kept in segregated bank accounts in top-tier banks.

Furthermore, eToro offers its users negative balance protection in case of market shocks. If for example you trade with high leverage and something happens in the market that causes a negative balance, eToro will simply adjust the account balance to zero again.

The negative balance protection applies to both retail and elected professional clients.

Fees

eToro makes money through its trading fees and non-trading fees.

Trading Fees

When you buy a real stock (without leverage), you pay zero commission, no markup, no stamp duty, and no additional broker fee.

If you trade stocks with leverage or go short, then it becomes a CFD trade and will have a spread markup (difference between bid/ask).

Real stocks: 0.00%

Forex: From 1 pip

Crypto: 1% + bid/ask spread

Commodities: From 2 pips

Indicies: From 0.75 points

Stocks / ETFs (CFD): 0.09%

Crypto (CFD): 1% + bid/ask spread

CFD trades are also subject to an overnight fee (swap), which can be either negative or positive depending on position size, long/short direction, and instrument.

Non-Trading Fees

After 12 months with no login activity, a $10 monthly inactivity fee will be charged on any remaining available balance. No open positions will be closed to cover the fee.

eToro charges a $5 withdrawal fee to cover some of the expenses involved in international money transfers.

If you deposit in another currency than USD, eToro will charge a conversion fee.

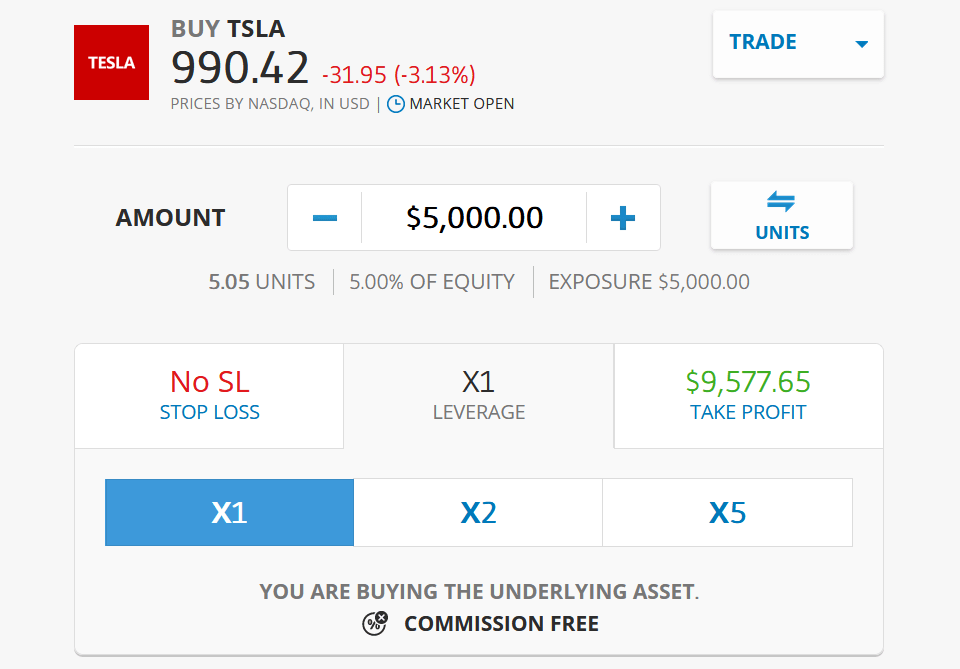

Leverage

Leverage is only applicable when trading CFDs and the maximum leverage will depend on which instrument you want to trade.

You can trade CFDs with zero leverage as well (1:1).

Cryptos: Up to X2

Stocks and ETFs: Up to X5

Commodities, indices, and exotic currencies: Up to X20

Major currencies: Up to X30

The leverage is not “built into” the instrument and you are entirely free to choose how much you want to leverage your trade.

If for instance, your investment in Tesla is $5,000 and you select X5 leverage, then your exposure in the Tesla stock will be $25,000.

eToro Platform

eToro has a single proprietary trading platform available through web browser, IOS, and Android.

Instruments

eToro is a multi-asset platform, which means you can both invest in real stocks and cryptos and trade in the underlying asset through CFDs (contracts for difference).

When you trade a CFD, you can use leverage and go short (profit on falling prices).

You can also copy other traders automatically (more on that later).

All in all, eToro offers trading and investing in more than 3000 instruments from a single account.

- 2000+ Stocks (real and CFD)

- 100+ Cryptos (real and CFD)

- 260+ ETFs (real and CFD)

- 13 Indicies (CFD)

- 32 Commodities

- 49 currency pairs

In addition to those aforementioned instruments, you can invest in CopyPortfolios. These are carefully constructed portfolios that have a theme or certain specialization.

Customer Support

eToro can be contacted in writing through their ticketing system. Questions are answered within a reasonable time.

You cannot contact them through telephone or live chat. Some eToro Club members get an Account Manager who can be contacted directly.

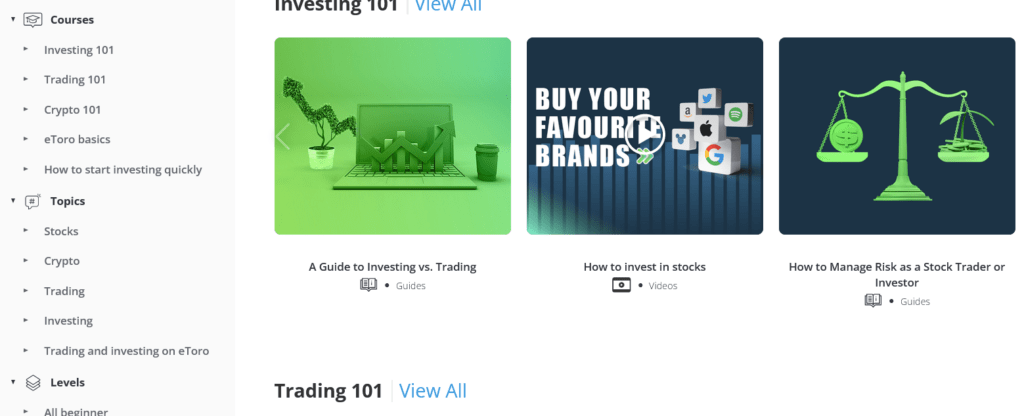

Education and Research

eToro has a massive offering of educational material and up-to-date research and analysis.

eToro’s Online Trading Academy

This is an educational hub jam-packed with videos, guides, and articles about trading and investing.

eToro Market Insights

eToro publishes daily market insights on their blog which covers market news and events.

The Bull Club

The Bull Club interviews some of the most successful investors and financial leaders in the world.

eToro Plus

eToro Plus provides in-depth reports, summaries, and analyses of trends and markets.

Business Model

eToro primarily makes money through spread markups, commissions (if applicable), and non-trading fees.

When trading CFDs, eToro applies a Market-Making model which means they are the counterparty to your trades.

Experience with eToro

We have traded extensively with eToro since 2014 and our experience has overall been outstanding.

We have for the most part been trading foreign exchange (FX) and investing in US stocks.

The platform is easy to use and spreads are fairly competitive.

However, the platform sets big limitations for advanced traders and the spreads can be too high for active day traders and scalpers.

The account currency is nominated in USD which means deposits from other currencies are subject to a conversion fee.

Experiences from other users (Trustpilot, app reviews) points out a user-friendly platform with a great offering, but limited and slow customer support.

The history behind eToro

eToro (originally called RetailFX) was founded in 2007 by the two brothers Yoni and Ronen Assia.

eToro was initially an ordinary forex broker, and in 2010 they launched what was then referred to as the eToro OpenBook. This has evolved into the very well-known social trading platform eToro offers all its customers today.

eToro’s OpenBook brought all users together on a social platform (like Facebook) and enabled them to share analytics, ROI, portfolio composition, etc.

In addition, through the eToro OpenBook, you could choose the traders who performed best, and copy everything they did – completely automatically.

This made eToro very popular with retail investors – not just traders…

In 2014, eToro began offering cryptocurrencies, and Bitcoin was first introduced on the eToro platform in the form of a Bitcoin CFD.

In 2015, eToro began offering more cryptocurrencies in a “physical” state – i.e. not as CFDs.

This brought in a massive influx of crypto investors and the user base grew by millions.

In recent years, eToro has also chosen to offer physical shares (not only as CFDs) without charging a commission.

Conclusion and Verdict

We believe eToro is first and foremost suitable for investors and traders who are new to trading.

The spreads when trading CFDs is a bit higher than most competitors and if you trade actively, these kinds of costs will eat into your profits.

eToro has a massive crypto offering but a 1% commission in addition to a high spread, makes it too expensive for active crypto traders.