Capital.com is a global broker established in 2016 and regulated in several jurisdictions including the United Kingdom (FCA), EU (CySEC), and Australia (ASIC).

With well over 6100 instruments available – including more than 300 cryptocurrencies – through an AI-enabled platform, makes Capital.com a great choice for active traders.

0.00% commission trading with low spreads and low overnight rates (swap), means that many traders can save costs by switching to Capital.com

Capital.com is also fully integrated with TradingView, and you can connect your trading account and trade directly from the TradingView charts.

In our Capital.com review, we uncovered tight spreads, very low fees, a super user-friendly platform, and tons of educational material available to clients.

Note that cryptocurrency CFDs are not available to UK clients.

| 💡 Founded | 2016 |

| ⚖️ Regulation | FCA, CySEC, ASIC, FSA |

| 🖥️ Platforms | Proprietary, MT4, TradingView |

| 💳 Min. deposit | $20 |

| 💰 Base currencies | USD, EUR, GBP, AUD, PLN |

| 🔑 Type of broker | Market Maker |

| ☎️ Support | 24/7 |

| 💸 Leverage | 1:30 |

| 🔗 Website | capital.com |

Capital.com Pros and Cons

- Fantastic trading platform

- FCA regulated

- TradingView integration

- 24/7 customer support

- Low spreads without fees

- 6100+ Instruments

- 300+ Cryptos

- Massive educational offering

- Negative balance protection

- Great mobile app

- No Copy Trading

Account Opening

The process of opening an account with Capital.com is simple and straightforward:

Step 1: Register an account at Capital.com

Only email and password are required to open a demo account.CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83.45% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Complete the registration and verify your account

Submit some basic personal data and upload the required documents to verify your account.

Accounts are usually verified within 24 hours.

🏆 Best CFD Platform 2022

✅ 6100+ instruments

✅ Web Platform, MT4 & TradingView

✅ 470+ cryptos

✅ Tight spreads with 0 fees

✅ Fast 24/7 customer support

Deposit and Withdrawal

Capital.com covers all fees associated with deposits and withdrawals, and traders can use a variety of methods including Visa, Mastercard, Trustly, PayPal, Wire Transfer, and Apple Pay.

There are five account base currencies that traders can choose from: GBP, EUR, AUD, USD, and PLN.

This is a limited collection in comparison to other similar brokers and this does not provide sufficient wiggle room for traders to avoid paying a conversion fee.

Withdrawals are processed super quickly and with zero fees.

Regulation and Security

Capital.com is regulated in four major jurisdictions and has offices across the globe.

Which regulated entity you open an account with, will first and foremost depend on your country of residence.

- Capital Com (UK) Limited (“CCUK”) is authorised and regulated by the Financial Conduct Authority (“FCA”), under register number 793714.

- Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17.

- Capital Com Australia Limited is regulated by the Australian Securities and Investments Commission (ASIC) under AFSL 513393.

- Capital Com Live Stock Investing Ltd is authorized by the Seychelles Financial Services Authority (FSA) with license number (SD101).

All retail accounts – regardless of regulated entity – has full negative balance protection if the account value were to go below zero.

Deposits from clients are kept in segregated bank accounts with major banks and the broker is regularly audited by Deloitte which is one of the most renowned and respected financial auditors in the world.

Fees and Spreads

Capital.com is a 0.00% commission broker and earns money primarily through spreads (difference between the Buy and Sell prices) and overnight fees.

Trading fees

The trading fees can be divided into spreads and swaps (overnight fees).

The spreads are extremely tight and start from 0.6 on EURUSD, 1.0 US Tech 100, 0.18 Gold Spot, and 0.02 Crude Oil Spot.

The broker imposes swap rates on overnight positions with leverage but this is applied only to the borrowed amount on cryptocurrencies and shares.

With commodities, indices, and forex, the swap rates are applied to the value of the whole position.

Non-trading fees

Non-trading fees are virtually non-existent as there is no inactivity fee charged if a client does not trade for a particular period while there are also no deposit, withdrawal, or account fees.

Leverage

At Capital.com, retail traders have access to maximum leverage of 1:30 across all regions of operation and regulation, but for professional traders, the leverage can be as high as 1:500.

However, in such cases, the negative balance protection is limited for accounts leveraged up to 1:50 which means at any leverage beyond that, a professional trader’s account is not covered by negative balance protection.

The leverage will also depend on the instrument traded.

A client who wants to change their classification from Retail to Professional must fulfill two of the three criteria below:

- Trading portfolio must be in excess of €500,000.

- Ten relevant trades of substantial sizes must have been executed in the previous quarter.

- The trader must have worked in the financial sector in relevant field for a minimum of one year.

🏆 Best CFD Platform 2022

✅ 6100+ instruments

✅ Web Platform, MT4 & TradingView

✅ 470+ cryptos

✅ Tight spreads with 0 fees

✅ Fast 24/7 customer support

Trading Platforms

Capital.com has its own proprietary trading platform available through Web, IOS, and Android.

In addition, they offer a full TradingView integration and MetaTrader 4.

Web Platform

Their own proprietary Web Platform is available in over 20 languages with a user-friendly feel as well as an immaculate design.

It is easy to locate crucial functions such as search functions and portfolio reports but customization of the platform is limited.

The platform has a secure two-step login option which is a big plus and will further secure your trading account.

The search functions are efficient as there are preset categories that traders can search such as indices, commodities, and US stocks while there is also a search bar where manual searching can be conducted.

The platform also has the basic order types available while advanced ones are absent. The following order types are available: stop-loss/take-profit, market, guaranteed stop, and limit/stop.

Unfortunately, it is impossible to set price alerts and notifications but there are clear portfolio and fee reports. These are located under the tab for ‘Reports’ and traders can send these reports to their email addresses and download them as a CSV file.

The charting experience is extremely pleasant and you are able to seamlessly switch between six tabs.

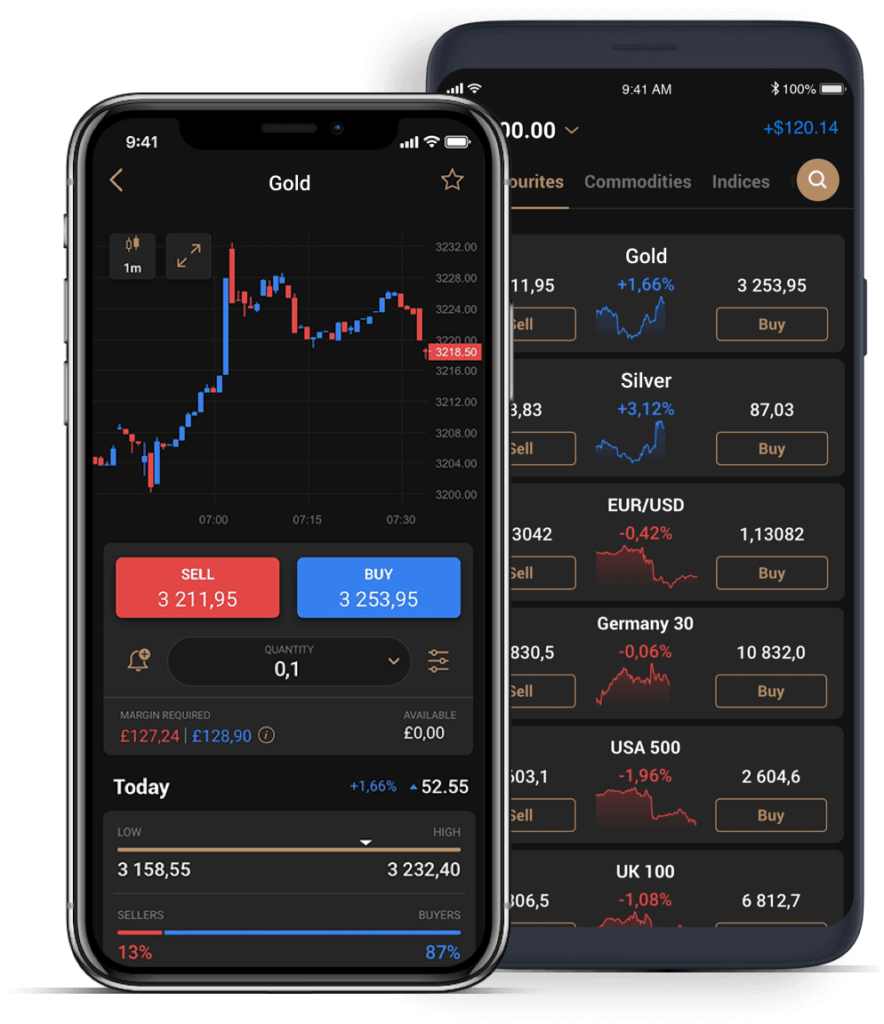

Mobile trading platform

This is the mobile version of the broker’s proprietary platform as it is also user-friendly, has an updated design, and offers the security of a two-step login as well but unlike its web trading counterpart, price alerts are available.

If the trader is using an iOS device, it’s possible to use biometric authentication thus adding an extra layer of security to the two-step login but this is not available on Android devices.

The search functions also work similarly to that of the web trading platform while similar order types are available as well.

As mentioned earlier, traders can set price alerts and notifications on the mobile platform which can be done by clicking on a specific asset and choosing the price level they are interested in seeing notifications about.

MetaTrader 4

Capital.com offers the industry-standard MetaTrader 4 (MT4) platform.

🏆 Best CFD Platform 2022

✅ 6100+ instruments

✅ Web Platform, MT4 & TradingView

✅ 470+ cryptos

✅ Tight spreads with 0 fees

✅ Fast 24/7 customer support

TradingView

You can easily connect your trading account with your TradingView account and trade directly from the TradingView charts.

Select Capital.com from the Trading Panel in TradingView and follow the instructions.

Instruments

Capital.com has a massive offering of CFD instruments covering five asset classes.

There are 138 currency pairs, 5373 stocks, 37 commodities, 23 indices, 100 ETFs, and 477 cryptos available for trading.

The crypto offering is perhaps the most impressive we have seen so far and crypto trading is available 24/7.

Customer Support

Customer support at Capital.com is available 24/7 primary through phone, email, and live chat.

You can also contact the broker via Telegram, Facebook Messenger, WhatsApp, and Viber which is a big bonus.

With email support, satisfying answers are provided within a day irrespective of how complicated some of the questions are.

Live chat support also works excellently as prompt and pertinent answers are provided regardless of the time a client wants to use the live chat service.

Connecting with an agent does not take a lot of time.

Education and Research

The education and research content offered by Capital.com are massive:

- Platform tutorial videos

- Webinars

- Glossary

- Excellent educational articles

- Demo account

- Learning courses (on different topics and embedded with a quiz)

- General educational videos

The educational section is structured so that every client can always find something new to learn.

The availability of a demo account tends to make life easier as traders can test their strategies and determine their solidity and suitability. Traders can also have an idea of how the platform works in terms of execution speeds and trading features.

The educational articles are categorized based on the asset class while also incorporating integrated videos. Glossary provides additional information while webinars allow traders to learn from real-life experiences which could help them to build consistency as traders.

The educational section of this broker also includes Investmate which is only available on the mobile platform for iOS and Android devices.

Investmate allows traders to access every educational tool the broker offers on their mobile devices.

The broker also has an official YouTube channel where there are over 600 videos along with free 30-minute webinars hosted by one of the broker’s senior experts.

There is a newsfeed that can be found under the ‘Discover’ menu icon; it comprises relevant images and charts while it is well-integrated into the platform and easy to read.

There are other research tools as well such as trading statistics which provide information on the most volatile or traded instruments thus guiding the clients in their trading decisions.

Trading Features

This broker does not support social or copy trading and neither does it have PAMM accounts.

Every client that opens an account with Capital.com is assigned an account manager who serves as the first point of contact for any problem the client might be experiencing on the account.

🏆 Best CFD Platform 2022

✅ 6100+ instruments

✅ Web Platform, MT4 & TradingView

✅ 470+ cryptos

✅ Tight spreads with 0 fees

✅ Fast 24/7 customer support

Business Model

Capital.com endeavors to employ a transparent means of operating by making all relevant information about the fees charged available to clients across different financial instruments available for trading.

Part of the business model is to provide clear portfolio and fee reports that will make it easy for traders to find their profit-loss balance as well as the commissions they paid.

While most of the trading done with this broker are free of commissions, the spreads are built into the cost of each trade which is how the broker makes its money.

It also charges swap fees on overnight positions and the fees vary with the instruments being traded.

For some instruments, the fee is partial while for some, the fee covers the entire position value of a specific trade.

Overall, due to the depth of its liquidity providers, the broker can provide tight spreads to its clients (which inevitably reduces the cost of trading) without diminishing its own ability to be profitable.

Experience with Capital.com

We tried creating a sub-account for trading real stocks but it was hard to do and we had to reach out to customer support where an agent had to manually set it up for us. So, maybe the broker can try to work on that so the account is easier to set up.

When we tried reaching out to customer support, we were responded to promptly by an agent whether through email or live chat.

We also got satisfactory answers to all our questions; with email support, we automatically got FAQ pages that were relevant to our questions once we sent our email.

However, the broker can improve on the phone support because we tried to contact customer support agents on the phone but we had no luck as we kept getting redirected to live chat and email support.

That needs to be corrected or removed totally as a means of contacting customer support so that clients are not misled.

Overall, the broker provides its clients with a seamless experience by making available a proprietary trading platform that enables clients to capitalize on the latest technology to engage in smart trading.

It also employs that technology to provide clients with information that will be paramount to their trading experience as a whole.

🏆 Best CFD Platform 2022

✅ 6100+ instruments

✅ Web Platform, MT4 & TradingView

✅ 470+ cryptos

✅ Tight spreads with 0 fees

✅ Fast 24/7 customer support

History behind Capital.com

Capital.com was established in 2016 under the ownership of Capital Com SV Investments Limited with offices in four major countries in Europe.

Ever since its establishment, Capital.com has continued to grow as it has emerged as a leading broker in the trading industry in Europe.

With its AI-powered proprietary platform that provides clients with a seamless trading experience, the broker has continued to impress traders and institutions around the world as it was voted ‘Most Innovative Tech 2021’ by TradingView.

The broker reported a 27% increase in new clients for the first quarter of 2022 along with a rise in trading activity thus leading to a 36% growth in the total trading volumes of its clients across all markets.

Capital.com is undoubtedly one of the fastest-growing brokerage platforms in Europe and as it takes in more clients, there is a likelihood it will continue to improve and enhance its operations to satisfy the needs of its clients.

Conclusion

Capital.com is a solid broker with a high level of regulation from two tier-1 regulators while also being regularly audited by a renowned global financial auditor which means it is reliable.

Regardless of whether traders are beginners or experienced, the broker ensures that it has something for everyone.

While this broker is not without its weaknesses particularly as some features are missing despite the advanced technology available to it.

It also has some strengths such as 24/7 customer support, tight spreads which significantly reduce the cost of trading, and educational tools which will undoubtedly greatly benefit novice traders.

The limited selection of instruments to majorly forex and CFDs is a bit of a setback but there is still a substantial range of instruments that will greatly interest traders.

The negative balance protection is another attractive option as well as the investor protection even though it is limited to certain regions.

Considering the safety that comes with its high level of regulation, it is safe to say that Capital.com is a broker worth checking out.