Blueberry Markets has become a very popular broker among traders due to low trading costs and 24/7 customer support.

They offer trading in FX and CFDs (stocks, indices, cryptos, and commodities) through MetaTrader 4/5.

In this Blueberry Markets review, we will cover most aspects of the broker, including our own trading experience.

Key Facts about Blueberry Markets

| 💡 Founded | 2016 |

| 🏢 HQ | Australia |

| ⚖️ Regulation | ASIC, SCB |

| 🖥️ Platforms | MT4, MT5 |

| 💳 Min. deposit | $100 |

| 💰 Base currencies | USD, EUR, GBP, NZD, AUD, SGD, CAD |

| 🔑 Type of broker | No Dealing Desk (NDD) |

| ☎️ Support | 24/7 |

| 💸 Leverage | Up to 1:500 |

| 🔗 Website | blueberrymarkets.com |

Pros & Cons

- 1:500 leverage

- Fast withdrawals

- 24/7 customer support

- Spreads from 0.0

- No dealing desk

- MT4 and MT5

- Free VPS

- No EU or FCA regulation

- cTrader not offered

- High spread on NOK-pairs

Account Opening

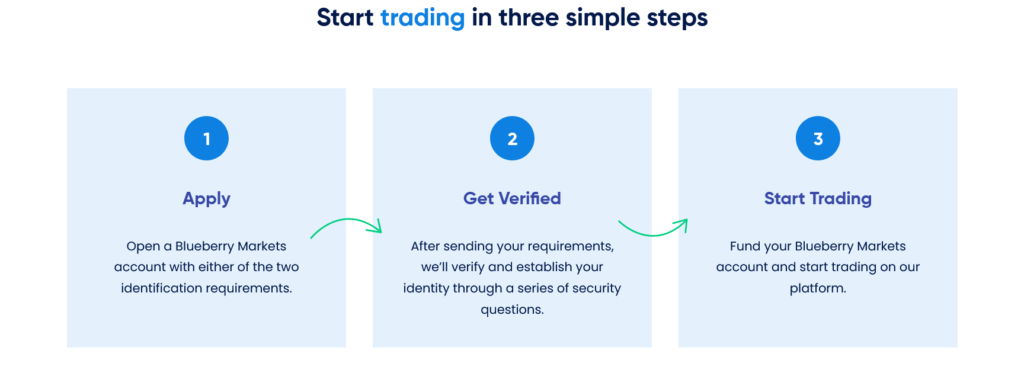

To open an account with Blueberry Markets, you simply need to submit your personal details and upload documents that verify your identity and address.

Step 1: Sign up via the account creation form

Step 2: Upload required documents and get verified

Steg 3: Deposit (min. $100) and trade

Once you have access to the Client Portal, you can create a trading account (demo or real) with either MT4 or MT5.

Blueberry Markets also facilitate Corporate, Trust, and Joint accounts.

Deposit & Withdrawal

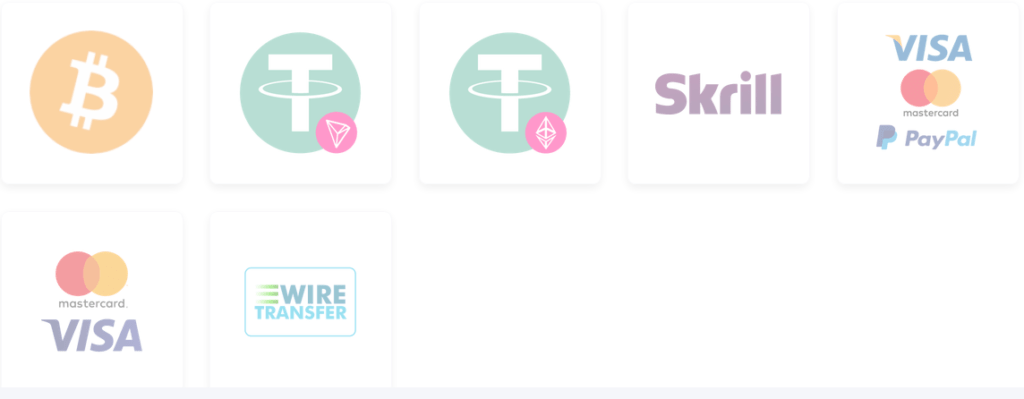

All major payment providers are supported such as VISA, Mastercard, Skrill, Neteller, and PayPal.

It’s also possible to transfer funds via traditional bank transfer.

You can even deposit using cryptocurrencies such as Bitcoin (BTC) and Tether (USDT).

Please note that crypto deposits are only available for clients outside Australia.

Withdrawals are processed within 24-hours.

Regulation & Security

Blueberry Markets Group (Blueberry Markets) is a registered business name of Eightcap Pty Ltd (ABN 73 139 495 944), regulated by the Australian Securities and Investments Commission (ASIC) with AFSL #391441.

Blueberry Markets Group is a registered domain of Eightcap Global Ltd (Eightcap). Eightcap is authorized and regulated by the Securities Commission of the Bahamas (SCB) (SIA-F220).

Please note that all Australian clients sign up with their ASIC-regulated entity, while non-Australian clients sign up with their SCB-regulated entity.

Deposit from clients is placed in segregated bank accounts with top-tier Australian banks regardless of the regulated entity.

Blueberry Markets offers negative balance protection for all clients regardless of the jurisdiction.

🏆 Best MetaTrader Broker 2022

✅ 1:500 Leverage

✅ Spreads from 0.0

✅ No Dealing Desk (NDD)

✅ Top Rated Broker with FPA

✅ 24/7 Customer Support

Leverage

The maximum leverage will depend on whether you are an Australian-based trader or not.

You can manually adjust the maximum leverage for your trading account(s) if needed.

Max leverage: 1:500

Max leverage (Australia): 1:30

Please note that some Australian clients can apply to become a “Wholesale Client” which means access to higher leverage up to 1:200.

Platforms

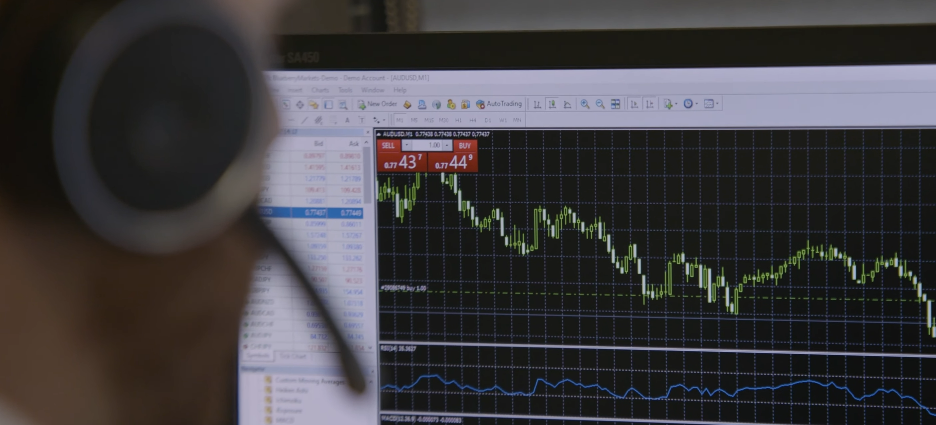

Blueberry Markets offers a full MetaTrader suite available through Web, Desktop, and mobile.

Account Types

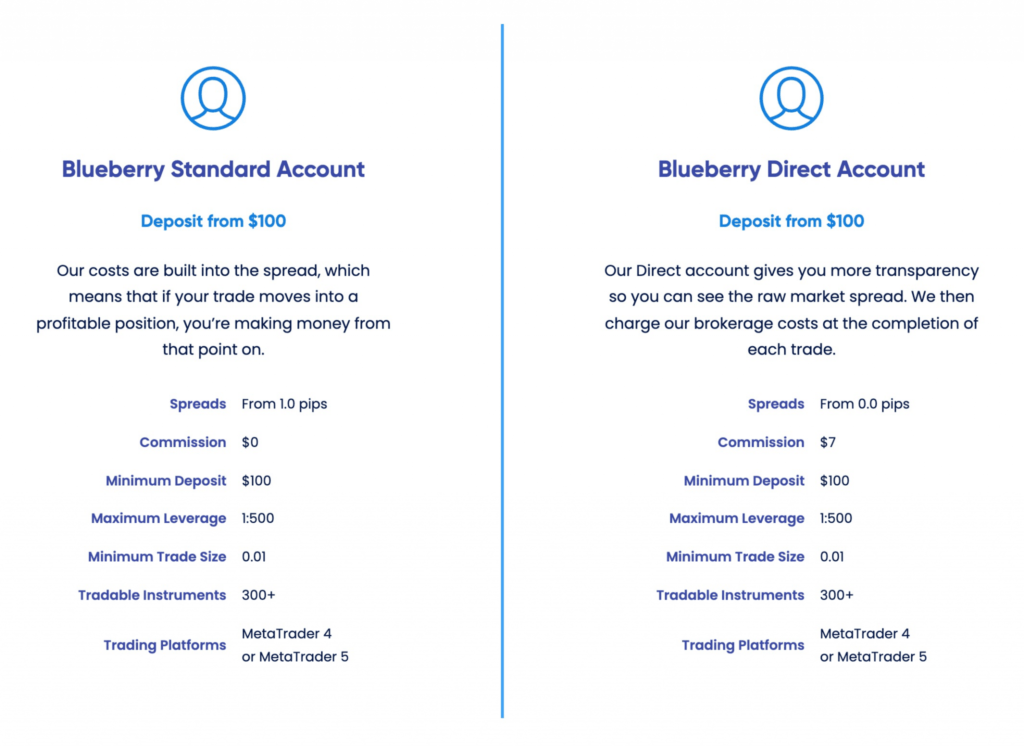

Blueberry Markets offers two account types: Standard and Direct. The only major difference is the fee structure.

The minimum deposit is $100 for both accounts and the minimum lot size is 0,01 lots (1000 units).

Standard Account

The Blueberry Standard Account is commission-free and offers spreads from 1 pip.

It’s perfect for traders who prefer traditional spread pricing when trading.

Direct Account

A Direct account has interbank spreads from 0.0 pips, but you must pay a small commission of $7 per round lot ($3,5 per side).

If you open a position worth 0.5 lots, then the total commission will be $3.5, and so on.

Perfect for traders who like raw spreads and use algorithmic strategies.

Premium Account

The Premium account is aimed toward high-volume traders and offers tailored pricing, spreads, and commissions.

Other benefits include:

- Priority support 24/7

- Priority withdrawal

- Advanced Market Insights

In order to become a Premium client with Blueberry Markets, you must cross a volume threshold as described below.

Demo Account

You can open a demo account with Blueberry Markets with $100,000 in virtual funds.

A demo account is a great way to practice and familiarize yourself with MT4 and MT5, risk-free.

Instruments

Blueberry Markets offers trading in forex and CFDs in several asset classes including stocks, indices, commodities, and cryptocurrencies.

Note that the MT5 platform offers more instruments than the MT4 platform due to technical limitations with MT4.

Customer Support

Customer support is available 24/7 via LiveChat, telephone, or email.

They are super-fast, efficient, and highly competent.

When writing this review, we tested the live chat with some technical questions, and they got answered within 30 seconds!

Education & Research

Blueberry Markets offer daily market updates, video tutorials, and a wide library of educational blog posts.

Trading Features

Free VPS

You can opt for a free forex VPS from Blueberry Markets as long as you trade a minimum of 10 lots per month.

The VPS is located with the trading servers which means your trades get executed faster and Expert Advisors can run 24/7.

PAMM / MAM

Blueberry Markets offers PAMM/MAM solutions to fund managers with relevant licenses and/or more than three years of trading experience.

Telegram Alerts

Blueberry Markets offers real-time trading alerts on Forex, Indices, Gold, Crypto, and Share CFDs, through the Telegram App.

Experience with Blueberry Markets

Blueberry Markets are highly rated by traders from all around the world.

They are rated five stars at Trustpilot, Google Business, and Forex Peace Army.

- Over 2,750 five-star reviews

- One-to-one support for all clients – demo or live

- Finalist for Finder’s Best Online Customer Service award in 2020 and 2021

- Respond in under 5 seconds on live chat

- Online 24/7 support

Given that forex brokers usually get a lot of negative reviews, we find these ratings really impressive.

Our experience with Blueberry Markets has been good so far.

We encountered no problems during sign-up, verification, and when making a deposit.

We traded forex through Blueberry Markets MT4 (Standard Account) and had low spreads and decent execution (could have been a bit faster).

We noticed a fairly big spread on exotic currencies such as NOK and SEK compared to other brokers.

The withdrawal process was super quick and without any complications.

Business Model

Blueberry Markets applies ECN-pricing with no dealing desk. No manual intervention takes place at any time.

They earn money through spreads and commissions (if applicable).

The History Behind Blueberry Markets

Blueberry Markets was founded by Dean Hyde, a former Axi-Trader executive. His vision was to launch a forex broker who was known for low spreads and a high level of client service.

Since then, Blueberry Markets has grown to over 30,000 traders.

🏆 Best MetaTrader Broker 2022

✅ 1:500 Leverage

✅ Spreads from 0.0

✅ No Dealing Desk (NDD)

✅ Top Rated Broker with FPA

✅ 24/7 Customer Support

Conclusion & Verdict

After testing out Blueberry Markets for ourselves, we can honestly say we are impressed.

Spreads and fees are low, and withdrawals are processed quickly and hassle-free.

Having access to customer support 24/7 is also a big plus.

If you prefer to trade with MetaTrader 4/5, then you should definitely check out Blueberry Markets.